Q3 2024 ISSUE:

Wealthies Nomination | DOL Q&A | Product Updates | Carrier Updates | Tech Tips | Connections 2024 Recap | Events

Quarterly Insights

A Welcome Message from Our Inaugural Chief Product Officer

I am incredibly excited to be here, as iPipeline’s very first Chief Product Officer. This is a pivotal moment for us as we embark on a journey to take innovation and data-driven insights to a new level while continuing our dedication and commitment to you, our BGA partners.

In this new role, my vision is to build a future together -- where our innovations enable you to harness the power of cutting-edge technologies, embrace bold ideas, and shift your clients’ experience through intelligent, connected workflows. We will leverage the immense data we have at our fingertips to showcase valuable insights into emerging market trends. This will enable us to anticipate the needs of the industry – and our BGA partners -- and personalize the experience more than ever before. The data will be our compass, guiding us towards the creation of products that will truly resonate with our partners.

As Chief Product Officer, I will be leading our strategic vision and roadmap for our product portfolio. I bring strong industry experience in driving strategic growth and accelerating innovation to this role, having worked for several technology firms, including Applied Systems, the leading global provider of cloud-based insurance technology, and Ceridian Dayforce, a global human capital management leader.

A key part of my role will be to focus on implementing change in response to the customer, which includes listening to our partners, hearing your voices, understanding your challenges, and then solving your problems. The voice of our customer will be at the heart of everything we do as we drive product innovation and deliver the types of exceptional products you’ve known us for, all while fostering growth and profitability for your company.

I look forward to working together, as we set new standards in the industry and continue to develop products that will secure financial futures for decades to come.

I invite you to connect with me on LinkedIn or drop me a note to share how we can better help you.

Thank you for your support as we enter an exciting new chapter, together!

Thank you,

.png?width=158&height=158&name=Katie%20Headshot%20(1).png)

Katie Kahl

CPO, iPipeline

BUZZ STATS: iSolve®

Product Updates

iSolve is transforming the way illustrations are run. Historically, agents and advisors rely on BGAs to provide all illustrations needed to socialize pricing with their clients who are looking for permanent products. With iSolve, agents can easily obtain the pricing for permanent products from the same place they are used to getting their term quotes. Once they select the right product and face amount for their client they can download the pdf of the illustration or ask the BGA team to run the one or two illustrations they are interested in.

iSolve is drastically improving the efficiency of the process – while reducing the overhead for BGAs to support their agents. Over the past year, the number of quotes generated by iSolve has grown by 240%! Interested in learning more about iSolve? Contact your account manager today!

1.8 Million

1.8 Million

1.8 million iSolve quotes between August 2021 - August 2022

4.4 Million

4.4 Million

4.4 million iSolve quotes between August 2022 – August 2023

240%

240%

Quotes in iSolve grew by 240% in one year

AGENCY SPOTLIGHT: DAY IN THE LIFE

Featuring Pete Buxton | VP, Senior Advisor Consultant, Signature Annuity at Highland Capital Brokerage

Q: How did you get into your current role?

A: I have been in this business for five years. Prior to my role here at Highland, I was in the military for 14 years. After serving, I went back to school on the GI Bill and got my degree. Then I started a landscape design company, but I wasn’t sure if that was what I wanted to do for the rest of my life. As I thought through my options, my dad, who is a financial advisor, introduced me to a connection at Highland Capital, and the rest is history.

Q: What does a typical day look like for you?

A: My day looks different now than it did my first two years. The first two years I put in a lot of time learning from Senior VPs in my role by shadowing them. I would call 80 to100 people a day to set up meetings for those VPs, and then I would sit in on the meetings. Now, I focus on my own target market: military veterans who are now financial advisors. I still make a lot of calls and set up a lot of meetings, but I now have a great referral base on which I’ve built my business. This allows me to spend time outside the office, meeting with my advisors face-to- face - something I really enjoy.

Q: Annuities are hot right now due to the interest rate environment. Beyond interest rates, why would you recommend purchasing an annuity?

A: The annuities that I specifically work with, Fixed and Index, tend to lean more toward the conservative client who may have a short runway when it comes to their “working years.” I like to refer to this runway as the "retirement redzone," which is 5 years before and 5 years after retirement. When you are in this category, you can’t afford to take a dramatic loss because you don’t have the time or income generation to make up for those downturns, like we saw in 2022. This is why we use Fixed and Index Annuities to lower the risk in a client’s portfolio. Even though you may not see those double-digit returns, you have eliminated all downside risk, and you have the ability to still capture decent upside returns in the market - all while protecting that nest egg that you worked so hard to achieve.

Q: What trends in annuities did you see last year and what are you seeing this year?

A: Last year, we saw a lot of market volatility, which made it difficult to keep up with the products and rates changing so frequently. Oftentimes, by the time a case was designed and everything was ready to sign, interest rates would change. We really had to be mindful of the timing in 2022. The interest rate environment is a little less volatile in 2023. Interest rates are still high, but they aren’t increasing every few weeks. This helps us to position products without experiencing the timing issues we saw in 2022.

Q: If you had $100,000, what kind of annuity would you purchase?

A: Well, I am not a typical annuity purchaser due to my age, but if I were to purchase an annuity for myself right now, I would go with a buffered annuity. A buffered annuity gives you market exposure with a buffer on the downside.

Q: If you had $100,000 to spend frivolously, what would you spend it on?

A: I’m huge into watersports, so I would probably put a bunch of it towards a nice wake boarding boat.

Pete Buxton

VP, Senior Advisor Consultant, Signature Annuity at Highland Capital Brokerage

We’re thrilled to have been selected from 1,000+ nominations as a finalist in this year’s WealthManagement.com Industry Awards!

The “Wealthies” honor outstanding achievements of the trailblazers and innovators shaping the future of the financial services industry. iPipeline has been nominated in the Insurance Service and Technology category for our latest ground-breaking solution – OneViewTM, the first status tracker in the annuity industry. OneView provides the tools needed to monitor, notify, and fix annuity orders, seamlessly, and in every step of the process!

Thank you for your continued support of iPipeline. We could not be recognized for such awards without the dedication of our partners and the commitment to our mission – to secure financial futures for all!

We’re incredibly honored and can’t wait for September 5 to learn who wins this category. Stay tuned!

Check out the press release and full list of nominees here.

We’ve heard a lot about the Department of Labor 2024 Fiduciary Rule. What is the current status of the DOL rule?

As we learned on July 27, a Texas court issued a stay on the matter. This now completely halts the enforcement of the new ruling, which means that as of now, BGAs are not required to comply with the outlines of the fiduciary rule as it stands.

The proposed rule has caused much uproar in the industry as earlier this year, the U.S. Department of Labor (DOL) aimed to take action intended to further protect retirement investors. This rule change would expand who is considered a fiduciary under the current Employee Retirement Income Security Act (ERISA).

It now appears that BGAs, advisors, and institutions will no longer have to worry about this ruling – at least for quite some time.

To read more on this topic:

- ThinkAdvisor: DOL Fiduciary Rule Halted by Texas Court

- InsuranceNewsNet: Second stay granted to defendants suing the DOL over its fiduciary rule

- Investment News: Second court blocks all aspects of DOL’s fiduciary rule

What exactly is this proposed rule and why is it important?

This latest version of the DOL fiduciary rule aimed to provide stronger protections for all retirement investors, along with several new provisions including an expanded definition of a fiduciary, strengthened conflict of interest provisions, increased transparency and disclosure requirements, broader applicability to accounts and products, and updated compliance requirements.

The rule was targeted to go into effect on September 23, 2024, and would have ensured that financial advisors and brokers act in the best interest of their clients when providing investment advice on their current retirement accounts, with the overall intent of improving the quality of investment advice from investment professionals – without worrying about their own financial gain.

How would this proposed rule impact BGAs?

This ruling would have several significant impacts to the BGA – and would hold BGAs to a higher standard -- similar to the one that exists for broker-dealers and their clients. The proposed rule would mean that BGAs would now fall under the fiduciary standard of providing investment advice.

Simply put, it would now ensure that you are recommending products that truly align with a clients’ best suitability. This rule would also require additional compliance requirements, enhanced enforcement, and significant penalties to make sure that BGAs adhere to these new standards.

Those in the industry – including those who attended our roundtable discussion at our Connections 2024 conference in Orlando in May – expressed concerns about this ruling. Concerns included that it would lead to increased compliance costs and higher regulatory burdens, as many insurance agents were not previously considered fiduciaries. There was the potential that these higher costs would be passed on to customers, which would then limit the access of financial advice for lower-income customers.

iPipeline remains committed to our BGA community and our vision of securing people’s financial futures through delivering innovative solutions that simplify, transform, and connect the industry.

We will continue to stay informed about this ruling and share any developments.

Adam Ducorsky

AVP, Product Management, iPipeline

Our world is digitally focused – and today’s customers want business transactions that are easy, fast, accurate, and secure. We shop online, bank online, wear digital fitness trackers and communicate via email and text messaging.

So why then, is the overwhelming portion of today’s annuities sales still relying on a slow, manual, and paper process?

We understand how critical e-Delivery is in our industry -- and in annuity sales. Do you?

Check out our latest blog and learn how critical it is to adopt e-Delivery and how it could transform your business!

We’re excited to share that we’ve automated* the process of activating new life insurance products for distribution in our iService portal. iService is our administrative tool that enables you to configure your iPipeline products.

This time-intensive manual process has transformed into a fully automated process -- making it faster, easier, and more efficient while providing you with immediate access to life insurance products from various carriers.

Now you no longer need to turn on any new products as they are added to the iPipeline platform – alleviating this administrative task for you!

With this automated process, you can expect immediate benefits to your business, including:

- Alleviating the administrative burden of monitoring new product announcements and setting up new products via iService.

- Eliminating the complexity of iService product setup and any associated errors from your teams.

- And confidence that new products will be available via iGO®, LifePipe, iSolve®, QuoteAPI, FormsPipe, and Illustrations.

For those who do not want to automate the process and would rather selectively exempt certain GAIDs, you can revert to the manual process. This will then allow you to select individual products as they become available.

Login to iService now to explore what this new process can do for your business.

If you have questions, please contact your Customer Account Manager.

*This automation is based on a straightforward set of business rules: If you are currently enabled to sell a certain product type from a specific carrier, then any new product of that same type, launched by that carrier, will automatically be enabled for you.

We’ve given XRAE® a make-over, complete with a new user interface, a more modern look and feel, and a consistent and complimentary design of our other iPipeline applications for BGAs. Designed with accessibility in mind, we’ve also made the interface compliant per the standards of WCAG (v2.1 Level AA).

Our enhancements to XRAE include:

- It connects to our LifePipe quote engine: This provides access to rate class results and term quotes. As you navigate through the XRAE questionnaire, you can view impacts to rate class and premiums.

- It's also a multi-tenant application: Accessing the same security and user accounts as our other BGA applications, XRAE is now optimally designed for agents in the field via their agent portals, in addition to BGA back-office users.

- XRAE is now included in the e-SSENTIALS® bundled pricing for BGAs: If you have an e-SSENTIALS license but cannot access XRAE, please contact our support team to extend these capabilities to your agents.

When it comes to the seamless operations of your agency, it’s critical to have the right Agency Management System. An efficient AMS boosts the productivity of your agency while increasing your level of growth and success.

Yet, finding the right system can be challenging. We feel your pain.

Click here for our latest blog post in which we delve into 6 pivotal factors to consider when selecting the right AMS for your organization.

Dear The Forms Guy,

The economy is a bit tight nowadays, and lately our agency hasn’t been receiving as many cases as we have in the past. My boss tells us we have nothing to worry about, but this makes me worry even more. What are some ways that I can increase my visibility at the agency, so if there are changes coming down the road, I’m in a better position to keep my job?

- Anxious in the Agency

Have a question for The Forms Guy?

Need some advice? Submit your questions here!

Dear Anxious,

We’ve all been anxious in the past about job security.

One of the best ways that you can become invaluable is to be the technology champion at your agency. Take the time to learn how to administer all your back-end systems - like your CRM, Agency Management System, iGO e-App, illustration systems, and other tools. You might already have a system administrator, but it’s not a bad idea to have a backup. Make your goals known amongst your coworkers and those who make hiring decisions. If something unfortunate happens, you can list your administrative experience with those programs on your resume.

Above all, don’t just wait for bad news to happen. Make good things happen every day by giving 100 percent. I believe in you!

Optimistically yours,

The Forms Guy

-1-1.png?width=232&height=90&name=foresters_financial_pos_rgb%20(002)-1-1.png)

Transamerica

Go Live Date: 6/15/24

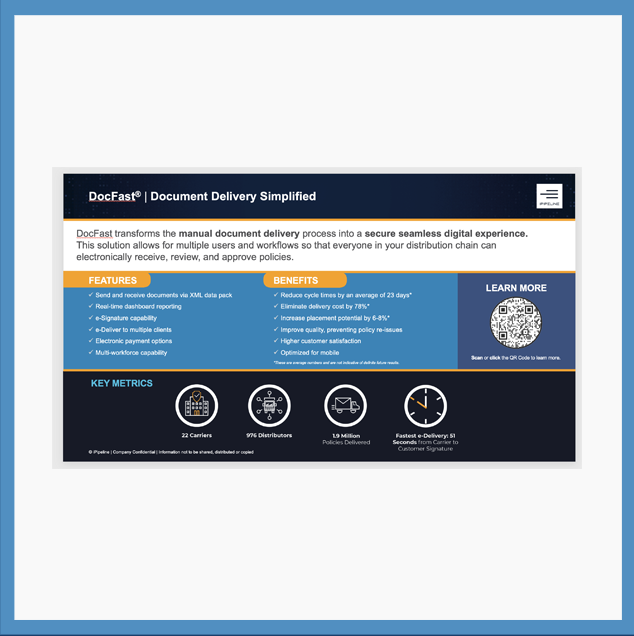

iPipeline Solution: iGO® and DocFast®

Insurance Products:

Trendsetter LB, Trendsetter Super, Financial Foundations IUL, Financial Choice IUL

Our new and improved iGO e-App® for term and IUL reduces the number of touches between you and the client after the application has been submitted thanks to more responsive questions upfront. *Some policies have seen app cycle time reduced by 8-14 days. Same great products, new and improved electronic applications.

Contact Transamerica Life Brokerage Sales Desk at 866-545-9058 or your Brokerage RVP

*Available in all states excluding CA, FL, NY, SC, and SD.

Symetra Life Insurance Company

Go Live Date: 7/09/24

iPipeline Solution: iGO®

Insurance Products:

Symetra SwiftProtectorSM

Learn more about SwiftProtector

With the iGO Admin Tool, you can access many aspects of the cases your agents are working on:

- Check application details.

- Resend e-signature emails and links.

- Confirm e-signature SSN, TIN, or PIN.

- View and download PDFs easily (requires SSO).

- View paramed details on applicable cases.

These features are designed to help reduce your cycle time and increase the quality of service provided.

For more information regarding the features available in the iGO Admin Tool, please click here, or talk to your Customer Success Manager or Account Representative to enable this tool.

Whether you joined us or not, don’t miss out on checking out all our favorite moments at Connections 2024! It truly was an incredible three days jam-packed with education, insight, networking, and fun – to get an inside look, dive into our event recap, where you can explore event photos, check out our event highlights, hear from CEO Pat O’Donnell, and so much more.

NEED HELP? Visit our Customer Portal

Privacy Policy | Terms of Service | Accessibility Statement | Modern Slavery Act Statement

© 2023 iPipeline, Inc. All Rights Reserved.

%20(2).png?width=300&height=65&name=Buzz%20Archives%20(300%20x%2065%20px)%20(2).png)